Hello dosto aaj ke is post me ham apko 4 new loan company ke bare me apko bataenge jisme loan lene ke liye apko koi bhi income proof aur cibil score ki jarurat nhi h aap bahut hi aasani se in application se personal loan prapt kar sakte hai vo bhi 1000 se lekar pure ke pure 2 lakh rupay Tak keval apke Aadhar card aur Pan Card me to pura post achhe se padhe aur hamne kuchh tarike bataye hai jaha se aap in application me loan apply karege aur post ke neeche hamne in application ke link bhi de rakhe hai jaha se aap directly loan apply bhi kar sakte hai.

Document Required

- Aadhar card for address verification

- Pan card for cibil score

- Applicants age must be more than 21 years

- Active bank account

- No loan default in last 3 months

Eligibility criteria

- Indian adult citizen

- Valid pan card

- Aadhar verification via digilocker

- Valid bank account details

- Minimum income : 12,000 for Salaried & 15,000 for small business/vendors PLEBGRAPH is 100% digital – No physical documents required just provide your pan, Aadhar card, and selfie to start

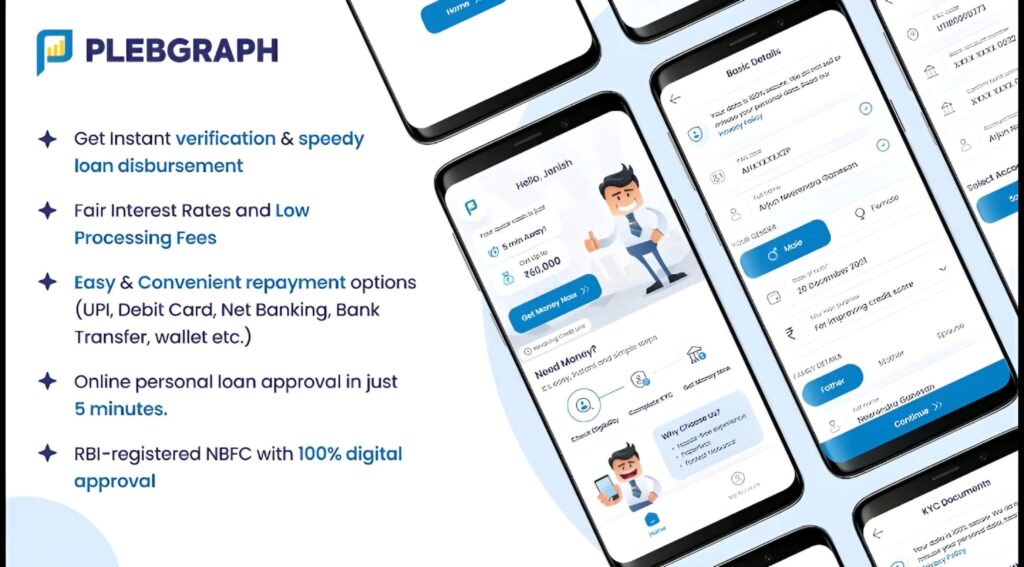

No.1 – PLEBGRAPH : Quick Loans For you Review 2024

Welcome to PLEBGRAPH, one of India’s fastest digital platforms for personal and small business loans powered by an RBI registered NBFC, PLEBGRAPH offers Quick and hassle-free access to credit without any paperwork say goodbye to long waiting times your approved loan amount can be in your account within just 5 minutes

1. Instant Personal Loan : whether you’re salaried or a self employed shop owner Plebgraph offers personal loans from 5000 to 60,000 and APR ranges from 14% to 36% for a tenure of 3 months to 24 months you only need your pan and Aadhar card to apply

2. Small Business support : fuel your business dream with our collateral free business capital loans up to 1,00,000 disgned to especially for small business and store owners to help you smoothly run day to day operations

3. Priority sector loans : we also extend loans of up to 50,000 to Priority sectors defined by the RBI if you are a woman entrepreneurs, artisan small vendor or part of the village and cottage industries we’re here to support you

Transparent pricing examples : imagine you borrow 36,000 for a year :

- Interest rate : 18% p.a

- Processing fee (including. GST) : 1274 (3%)

- Total interest : 3,600

- Monthly EMI : 3,300

- APR : 24.97% total repayment : 39,600 with a loan disbursals of 34,725

No. 2 – Bharat Loan App Review 2024

Bharat loan stands as your comprehensive solution for all Financial requirements life often presents unforeseen challenges especially in managing finances that’s precisely why we have crafted our instant personal loan services to be your steadfast and empathetic financially offering rapid and seamless solution precisely when you need them in life challenges often close doors leaving us feeling trapped and uncertain At bharat loan we understand the frustration of closed opportunities.

Key considerations before applying for a personal loan :

- Loan amount : minimum 5,000 to maximum 1 lakh

- Repayment tenure : minimum 2 months to maximum 12 months

- Rate of interest / annual percentage Rate (APR) : 35% (fixed)

- Processing fee : rs 2% loan amount

Note : GST on processing fee (exclusive) : 18%

Representative Example :

- Loan amount : 50,000

- APR : 35%

- Tenure : 12 months

- Processing fee: 1000

- GST on processing fee : 180

- Amount disbursed : 48,820

- EMI : 4,998

- Total repayment amount : 59,978

- Total interest : 9,978

No.3 – Incred Finance : Loan App Review 2024

Incred finance, India’s one of the best loan app allows you to get a personal loan of up to 10 lakhs within 15 minutes directly through your mobile phone whether it is for urgent expenses unexpected bills or your dream vocation we have you covered

Top features of incred personal loan mobile app :

- check your personal loan eligibility for free

- Track the status of your loan application

- Online KYC process : 100% secure

- Dedicated relationship manager to help you with the process

- Check your Repayment schedule & pending EMIs

- Recieve automated reminders for upcoming EMI payments

Why should you choose an Incred personal loan ?

- get instant loan up to 10 lakhs

- 100% online application process

- No collateral or guarantor needed

- Competitive interest rates starting from 13.99% p.a

- Repayment term : 3 to 60 months

- Choose your

Loan Terms :

- Annual interest rate : 21%

- Loan tenure : 36 months

- Monthly EMI : 3,767.5

- Total payment : 1,35,630 (36 x 3767.5)

- Total interest for 36 months : 35,630

Who can apply for an Incred personal loan

- Age bracket : 21 to 55

- Minimum in hand salary of at least 15,000

- Salaried employees getting salary directly in bank account

- Proprietor business with ITR and GST documents with monthly income of 25,000 or more

- Credit score of 700+ and healthy repayment history is preferred

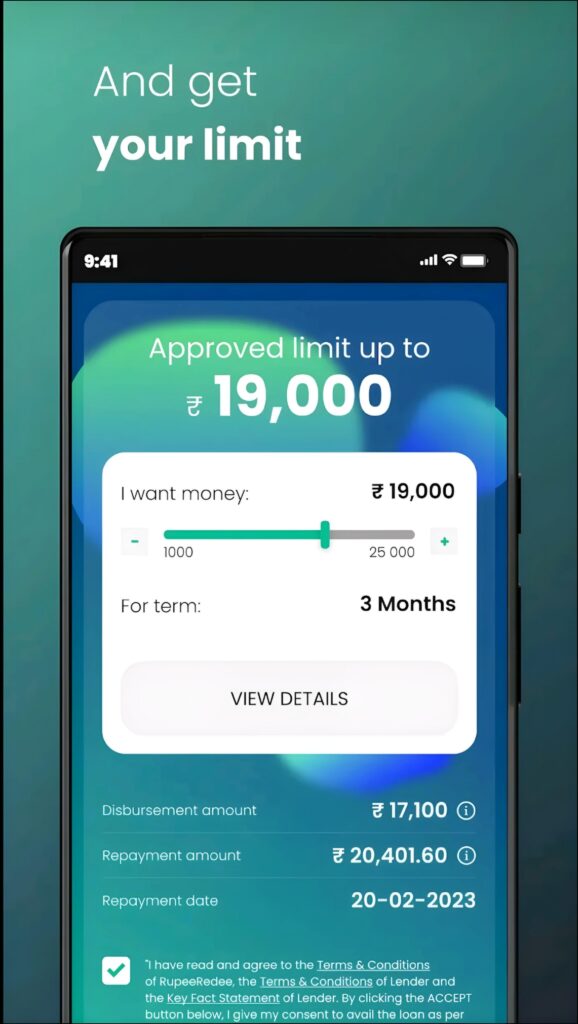

No.4 – Rupee redee personal loan app review 2024

Rupee redee will credit money in your account in 10 mins following simple application process

NBFC Lending partner : Finc friends private limited which is a registered NBFC with RBI

Fast loan approval and quick loan disbursal : with 100% online process get fast approval and quick loan disbursal

Loan for all purposes and needs : loan to fulfil all types of credit needs including covering emergency expenses consolidating debt, travel, shopping, bill payments, school fees and much more

Flexible Interest Rates and tenures : Flexi personal loans with interest rates 12% to 36% depending on your credit score also get flexible tenure option of 62 days to 6 months for repayment of the loan

Transparency with security : we only work with RBI certified NBFC

Top Features

- Simple EMIs : payback in 2 -12 months at your convenience

- 100% online : the application process is completely paperless

- Complete transparency : there are no hidden costs all costs are mentioned on application summary before processing of loan

Personal Loan Charges (example):

- Loan amount : from 2000 to 30000

- Minimum period of Payment : 62 days

- Maximum period of payment : 365 days

- Maximum annual percentage Rate : 36% to 160%

- Interest rate : 2.5% to 3% per month

- Processing fee : starting 10% of loan amount

- Service charge : starting 3% of loan amount

Representative Example of the total cost of loan is provided in example below :

Description in example below :

- Loan amount : 11000

- Loan tenure : 3 months

- Processing fee (10% inc GST) : 1100

- Service charges ( 3% per EMI inc GST) : 990

- Interest (32%) = 583.6

- Amount disbursed : 9900

RRB NTPC Exam Date OUT! Ab Check Karo Aur Prep Shuru Karo!

RRB NTPC Exam Date OUT! Ab Check Karo Aur Prep Shuru Karo!