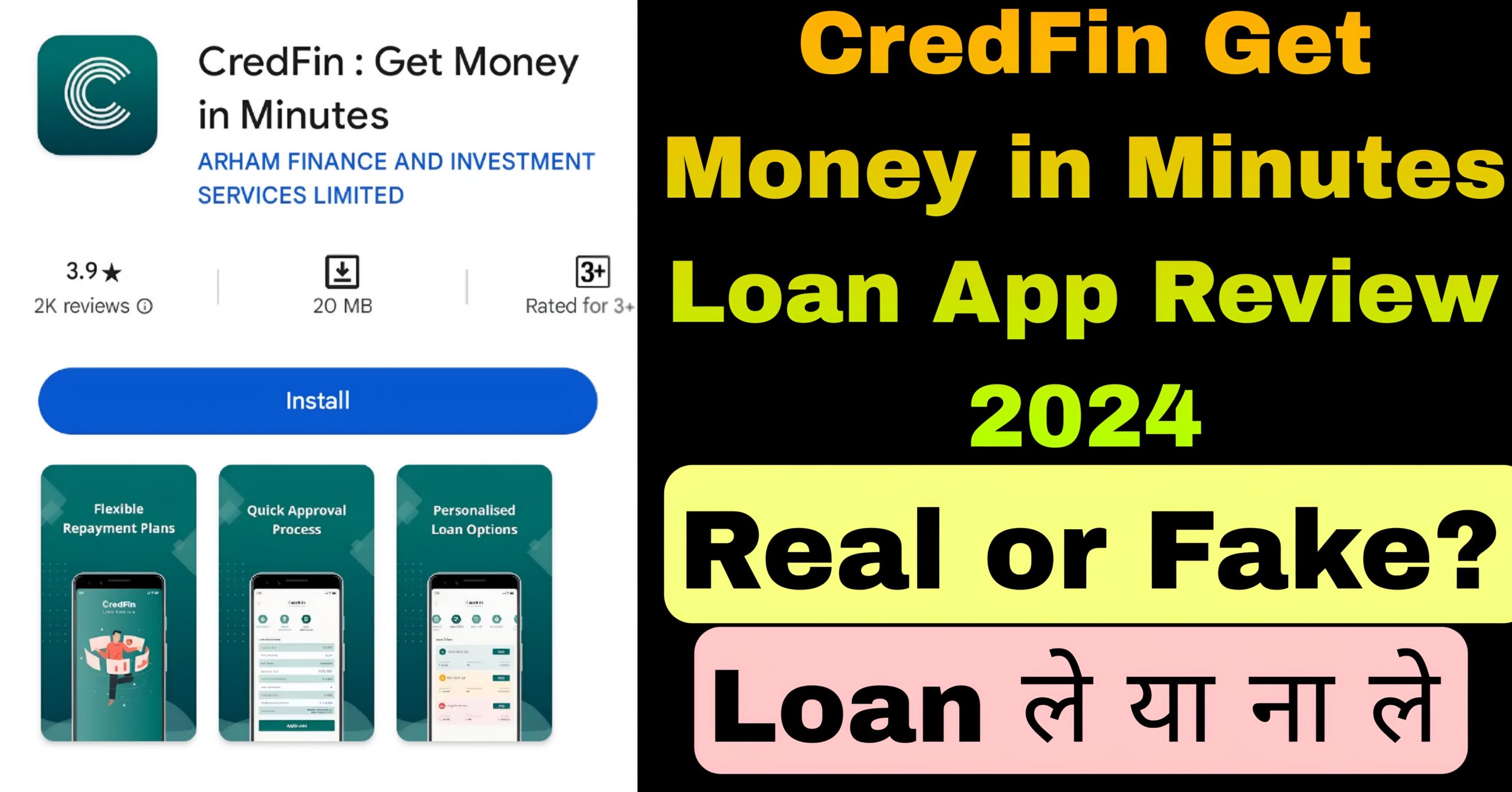

CredFin : smart lending for a better financial future we understand the importance of quick and accessible financial solutions and our app is designed to provide just that with our user friendly interface and advanced features, you can get the funds you need quickly our app is built to support multiple platforms, ensuring that you can access it anytime anywhere whether you prefer to use it on the web or through your mobile device,

we’ve got you covered we have taken into account the crucial attributes that users like you would expect from a loan app our app offers convenience, speed, and robust data protection, ensuring a seamless and secure borrowing experience

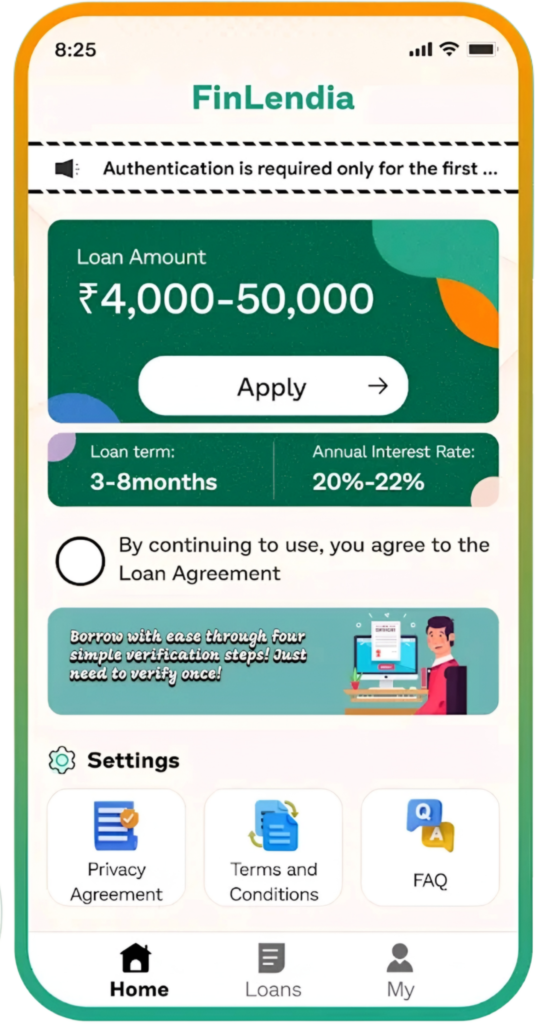

Finlendia Key Features :

Key highlights

No security deposit

No hidden costs

- Loan Amount : 5000 to 2 lakhs

- Loan tenure : 62 days to 365 days

- Annual percentage Rate range from 0% – 36%

- 100% digital process

- Accessible anytime, anywhere : weather our mobile app, access at your fingertips whenever you need it

- Minimal documentation : we requires minimal documentation, making the process smoother for you

- Instant approvals : completed applications are approved instantly ensuring a quick response to your financial needs

- Direct money transfer : once approved, the money is transferred directly to your bank account, providing swift access to the funds you require

- Transparent terms : No surprises clear terms and conditions for a worry – free borrowing experience

Why Choose Us?

-user friendly interface

-security and data protection, easy Repayments, direct disbursement

– Quick approval

Eligibility Criteria

- Salaried Individuals

- Above 21 years

- Minimum take – home salary per month 15K documentation

- Pan card for cibil score

- Aadhar card for address verification

- Salary account bank statement

Sample Calculation

- Loan amount : 20,000

- Tenure : 3 months

- Interest : flat 36% per annum

- Processing fees (incl.GST) : 708

- Disbursed amount : 20,000 – 708 = 19,292

- Flat interest : 20,000 3/12 36% = 1,800

- Total repayment amount : 20,000 + 18,000 = 21,800

- Monthly EMI : 21,800 / 3 = 7,267

- Total cost of loan : interest amount+ processing fees= 1,800 +708 = 2,508

Interest rates and other charges

- Interest rate and other charges from 0% to 36%

- Late payment charges : we charge a late payment fee not exceeding 8.33% per month on the amount due subject to a minimum of 500 + GST

- mandate reject charge : 250 + GST

- Bounce charges : 500 + GST

- prepayment charges : 0

- processing fees : (incl. Of GST) ranges from 590 to 11918 (depending on the loan amount & tenure

Approval process

- Login to the app

- Fill in some basic details and upload required documents

- Choose the loan amount and tenure

- Get the money transferred to your account safety and security :

- SMS : we collect your SMS to evaluate creditworthiness and determine the loan offer amount

- Device information : securely links the loan application to the users phone

- Location : ensures the service ability of a loan application and accelerates the KYC process

- Camera & media access : facilitates the upload of your selfie as part of the application process.

To read our policy for dues, visit :

CredFin is working with RBI complaint NBFC –

1.Arham finance and investment services Ltd contact us

for any kind of help or support, feel free to send an email to developer@arhamfinance.com